Most pharmacies carry hundreds of medications, but 80% of their drug costs come from just 20% of the products. That’s the 80/20 rule in action-and for independent pharmacies, the key to surviving financially lies in how well they manage the biggest slice of that 20%: generic medications.

Generics make up about 90% of all prescriptions filled in the U.S., but they only account for 20% of total drug spending. That’s a massive opportunity-if you know how to stock them right. Too little stock, and patients walk out empty-handed. Too much, and you’re tying up cash in pills that expire before they’re sold. The difference between profit and loss often comes down to one thing: your generic stocking strategy.

Why Generic Medications Need a Different Approach

Brand-name drugs are predictable. Once a drug hits the market, demand stays steady for years. Generics? Not so much. When a patent expires, five or six new generic versions can flood the market within weeks. One day, your pharmacy is ordering 500 tablets of the brand-name atorvastatin. The next, the prescriber switches to a new generic, and suddenly that brand-name stock is sitting on the shelf, collecting dust.

That’s not just a problem-it’s a financial drain. One pharmacy owner in Ohio lost $3,200 in brand-name inventory during a single atorvastatin transition because their system didn’t auto-adjust order volumes. Generic drugs aren’t just cheaper-they’re volatile. Their demand spikes, drops, and shifts faster than brand names. That means you can’t use the same old inventory rules you’ve been following for decades.

Generics also have shorter shelf lives. Because manufacturers compete on price, they often produce smaller batches with tighter expiration windows. A bottle of metformin might expire in 18 months instead of 36. If you’re not tracking expiry dates closely, you’re risking waste-and lost revenue.

The Core of a Good Generic Stocking Strategy

There’s no magic formula, but there are three non-negotiable practices that separate successful pharmacies from those struggling with overstock and stockouts.

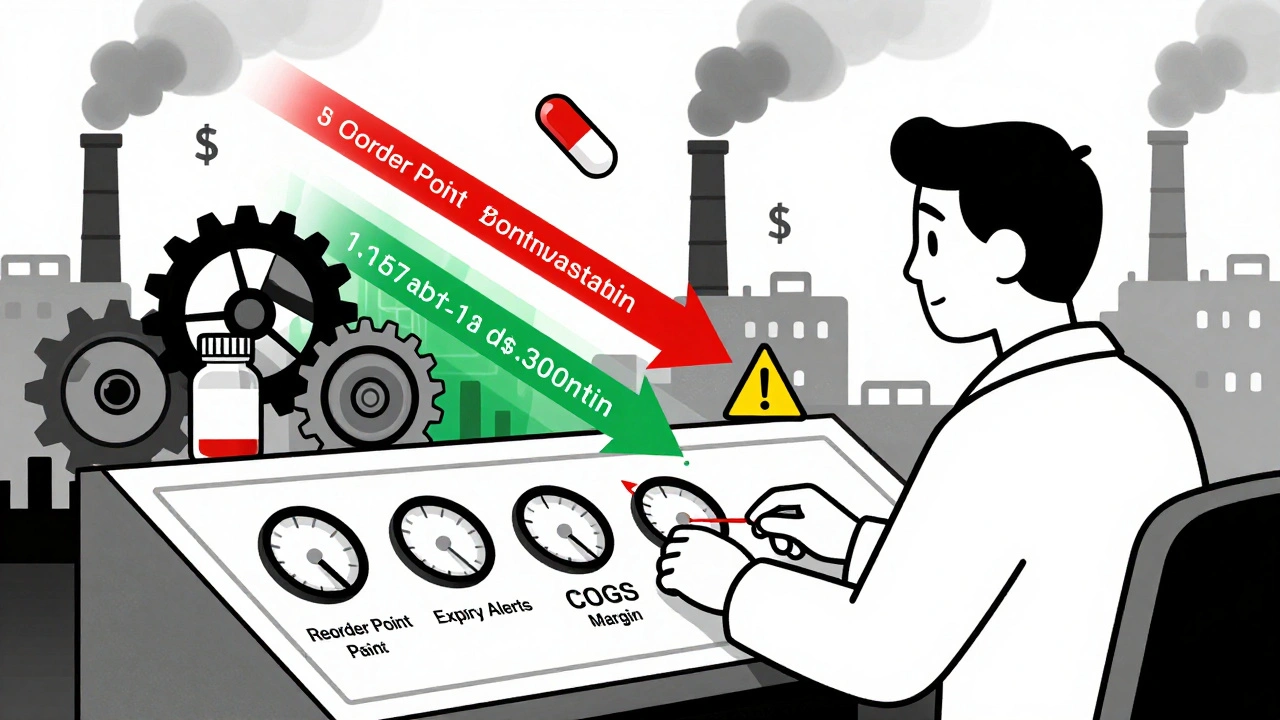

- Use the minimum-maximum method-Set a floor and ceiling for each generic. Never let stock drop below the minimum, and never let it rise above the maximum. For fast-moving items like ibuprofen or lisinopril, that might mean a minimum of 100 tablets and a maximum of 300. When stock hits the minimum, the system triggers an order to bring it back to the maximum.

- Calculate your reorder point-It’s not guesswork. Use this formula: (Average Daily Usage × Lead Time in Days) + Safety Stock. If you sell 15 bottles of metformin a day, and your supplier takes 5 days to deliver, your base reorder point is 75. Add 10% safety stock (8 more bottles), and you’re ordering when you hit 83. That’s how you avoid running out during a weekend rush or a flu season spike.

- Track cost of goods sold (COGS) per product-Not all generics are created equal. Some have 40% margins. Others barely break even after shipping and handling. Your software should show you exactly which generics are profitable. If a generic has low turnover and low margin, it’s time to drop it or negotiate a better price with your distributor.

Pharmacies using this data-driven approach report 10-15% lower inventory holding costs and 15% fewer stockouts. That’s not theory-it’s real numbers from independent pharmacies in Ohio, Texas, and New York.

How to Handle New Generic Entries

When a new generic hits the market, you have a 72-hour window to react. After that, patients start asking for it, and your brand-name stock becomes obsolete.

Here’s how to handle it:

- Check your formulary. Does your prescriber network allow automatic substitution?

- Look at your inventory system. Is it set to auto-reduce the brand-name order and increase the generic order?

- Call your distributor. Ask for the expected lead time and price. Some new generics come with temporary discounts to gain market share.

- Adjust your minimum-maximum levels. Start low-maybe 50 units instead of 200. Demand builds slowly at first. Don’t overbuy.

- Train your staff. They need to know how to explain the switch to patients. Many think generics are inferior. They’re not. They’re the same drug, same FDA approval, same active ingredient.

One pharmacy in Arizona reduced brand-name waste by 70% after implementing a simple rule: “If a new generic is approved and priced 30% lower than the brand, reduce the brand order by 80% within 48 hours.” That’s it. No software upgrade needed-just discipline.

Software That Makes a Difference

You can’t manage this manually. Excel sheets won’t cut it. You need inventory software built for pharmacy workflows, with these features:

- Automatic reorder triggers based on real-time sales data

- Expiry date tracking with alerts for stock nearing expiration

- Therapeutic interchange alerts-flags when a new generic enters a class your pharmacy stocks

- Supplier performance tracking (lead time, fill rate, price changes)

- Integration with your dispensing system so inventory updates in real time

Software with generic transition protocols scores 22% higher in user satisfaction than basic systems. Why? Because it doesn’t just track pills-it anticipates market shifts. One system, Clotouch, rolled out predictive analytics in late 2023 that cut brand-to-generic inventory imbalances by 28% in beta testing. That’s the kind of edge independents need to compete with big chains.

What to Stock-and How Much

Not every generic needs the same level of attention. Group them by turnover:

| Category | Examples | Stock Level | Reorder Frequency |

|---|---|---|---|

| Fast-Moving | Metformin, Lisinopril, Ibuprofen, Omeprazole, Levothyroxine | 1-2 weeks’ supply | Daily or every other day |

| Medium-Moving | Atorvastatin, Amlodipine, Sertraline, Glimepiride | 3-4 weeks’ supply | Weekly |

| Slow-Moving | Specialty generics like Sitagliptin, Duloxetine, Rivaroxaban | 1-2 months’ supply | Biweekly or monthly |

For fast-movers, keep at least three or four SKUs on the shelf. Patients don’t like being told, “We only have one brand.” If you run out of the most popular generic, they’ll go to CVS or Walmart. That’s not just lost sales-it’s lost loyalty.

Slow-movers? Don’t overstock. Keep just enough to cover 60-90 days of demand. If it hasn’t sold in 90 days, talk to your supplier about a return or price reduction. Many distributors will take back unopened generics if you’re proactive.

Staff Training and SOPs

Even the best software fails if your staff doesn’t use it right.

- Train everyone on how to log received inventory. One wrong entry-like putting 1000 tablets instead of 100-throws off your entire system.

- Implement a 24-hour return policy for unclaimed prescriptions. If a patient doesn’t pick up their generic refill, get it back on the shelf within a day. That simple step cut inventory discrepancies by 22% in one Michigan pharmacy.

- Create standard operating procedures (SOPs) for generic transitions. Write them down. Post them near the receiving area.

- Do weekly cycle counts on your top 20 generics. Don’t wait for the monthly audit. Catch errors early.

The learning curve takes 2-4 weeks. After that, it becomes routine. The key is consistency. Don’t let one person handle all inventory. Spread the responsibility. Accountability prevents mistakes.

Common Mistakes and How to Avoid Them

Here’s what goes wrong-and how to fix it:

- Mistake: Relying on historical data without adjusting for new generics. Fix: Recalculate forecasts every quarter. If you haven’t updated your algorithm since 2022, you’re already behind.

- Mistake: Overstocking slow-moving generics because “they’re cheap.” Fix: Use COGS and turnover rate-not purchase price-to decide what to keep.

- Mistake: Ignoring expiry dates. Fix: Set alerts for stock expiring in 30, 60, and 90 days. Offer early refills or discounts on near-expiry generics.

- Mistake: Not working with prescribers. Fix: If your state allows it, set up a collaborative practice agreement (CPA). That lets pharmacists automatically switch patients to generics without waiting for a new script.

One pharmacy in Illinois had eight stockouts of metformin in three months. Why? They were only keeping a two-day supply. After increasing to a full week’s supply and automating reorders, stockouts dropped to zero. The cost? Less than $1,200 in lost sales avoided.

The Bottom Line

Generic drugs aren’t just cheaper-they’re the backbone of pharmacy profitability. But they demand smarter management. The pharmacies that thrive are the ones treating generics not as a cost-saving afterthought, but as a strategic asset.

Start small. Pick five fast-moving generics. Set minimum-maximum levels. Turn on expiry alerts. Track COGS. Train your team. Watch your inventory costs drop and your fill rates rise.

The market won’t slow down. New generics hit the market at 15-20 per month. If you’re not adapting, you’re falling behind. The tools are here. The data is there. All you need is the discipline to use it.

What is the best inventory method for generic medications?

The minimum-maximum method works best for generics. It sets a low and high stock limit for each medication. When inventory hits the minimum, the system automatically triggers an order to bring it back to the maximum. This prevents both stockouts and overstocking. It’s simple, reliable, and works especially well for high-turnover generics like metformin or lisinopril.

How often should I update my generic inventory levels?

Update your inventory thresholds at least quarterly. But during major generic transitions-like when a new generic enters a popular drug class-review your levels weekly. Market shifts happen fast. If you wait six months to adjust, you could be stuck with expired stock or missed sales.

Should I stock multiple brands of the same generic drug?

Yes, for fast-moving generics. Patients and prescribers often have preferences. If you only carry one brand and it’s out of stock, the patient may leave without filling the prescription. Keep at least two or three options for top sellers like ibuprofen or omeprazole. This reduces lost sales and builds trust.

How do I handle expired generic medications?

Track expiry dates in your inventory system and set alerts for stock expiring in 30, 60, or 90 days. For near-expiry stock, offer early refills at a discount or work with your distributor on return policies. Many distributors will accept returns of unopened generics if you notify them early. Never let expired stock sit-write it off immediately and adjust your ordering to prevent future overstock.

Can I use the same inventory software for brand and generic drugs?

You can, but only if the software has specific features for generics. Generic drugs change faster, have shorter shelf lives, and need different reorder triggers. Basic inventory systems that treat all drugs the same will fail. Look for software that tracks therapeutic transitions, expiry dates, and supplier performance specifically for generics. Systems with these features reduce waste and improve cash flow.

How do I know if a generic is profitable?

Check your Cost of Goods Sold (COGS) per unit-not just the purchase price. Include shipping, handling, and dispensing costs. A generic that costs $5 to buy but takes 10 minutes to count and label may have a lower profit margin than you think. Use your pharmacy software to rank generics by net margin. Drop or renegotiate the ones that barely break even.

What’s the ideal percentage of generics in my inventory?

For independent pharmacies, aim for 65-75% of your total inventory value to be generics. That’s where the bulk of your prescriptions and profit margins lie. Don’t try to stock 90% generics by volume-some are slow-moving. Focus on value. High-turnover generics should make up the majority of your stock, while low-turnover ones stay minimal.

kelly mckeown December 4, 2025

i’ve been using the min-max method for metformin and lisinopril since last year and it’s been a game changer. no more weekend stockouts, and my pharmacist actually has time to talk to patients now instead of scrambling to reorder.

Tom Costello December 5, 2025

the COGS breakdown is something every independent pharmacy needs to stop ignoring. i used to think ‘cheap = good’ until i realized one of my ‘budget’ generics had a 3% margin after labor and shipping. dropped it. switched to a better distributor. profit jumped 12% in two months.

Siddharth Notani December 7, 2025

excellent breakdown. in india, we face similar challenges with generic volatility-especially after new NDA approvals. the 72-hour reaction window is critical. we use automated alerts + weekly cycle counts on top 15 SKUs. reduced waste by 31% in 6 months.

Cyndy Gregoria December 8, 2025

you’re not just managing pills-you’re managing trust. patients notice when you have their med ready. when we started stocking 3 brands of ibuprofen, our refill rate went up. simple. human. effective.

Akash Sharma December 8, 2025

interesting how the article emphasizes software but doesn’t mention cost barriers. many small pharmacies can’t afford Clotouch or similar systems-$5k/year is a lot when you’re barely breaking even. is there a free or open-source alternative that does half the job? maybe a modified version of OpenMRS or something built with Google Sheets + Zapier? i’d love to see a community-driven solution.

dylan dowsett December 10, 2025

you’re all missing the point. generics are a scam. the FDA doesn’t test them like brands. same active ingredient? sure. but the fillers? the binders? the coatings? totally different. that’s why some people get sick switching. you’re not saving money-you’re risking lives.

Susan Haboustak December 12, 2025

And yet you still stock them? How irresponsible. If you don’t believe in generics, why are you even in this business? You’re not a pharmacist-you’re a liability. And your inventory system? It’s a joke. You’re lucky you haven’t been sued yet.

Chad Kennedy December 13, 2025

lol so basically just buy more stuff and hope it sells? why not just print out a spreadsheet and call it a day? i’ve seen pharmacies do this and they still end up with expired pills. it’s not rocket science, it’s just lazy management.

Stacy Natanielle December 14, 2025

👏👏👏 THIS. I’ve been screaming this from the rooftops. The 80/20 rule is REAL. I tracked my top 20 generics for 6 months-turned out 3 of them were making 50% of my profit. Cut the other 17. Reallocated the cash. Now I have money to upgrade software AND pay my techs a bonus. 🤑💊 #PharmacyHacks

Wendy Chiridza December 15, 2025

we started doing weekly cycle counts on fast movers after a 400-pill miscount in january. now we catch errors before they become problems. also, always get a signed receipt from the delivery driver. saves your butt when the distributor says they never delivered

Casey Lyn Keller December 17, 2025

you know what’s really happening? Big Pharma is pushing generics so they can control the market. The FDA is in their pocket. The real profit is in the software companies selling you these ‘solutions.’ They’re all owned by the same 3 corporations. You’re being played.

Mark Gallagher December 17, 2025

you people are naive. if you think generics are safe, you haven’t seen what happens when a Chinese manufacturer cuts corners. I’ve seen pills that dissolved in the bottle. I’ve seen patients with rashes from ‘generic’ sertraline. The system is rigged. We need real testing-not this ‘same active ingredient’ nonsense. America deserves better.