Why You Can’t Always Get the Medication You Need

Imagine needing a simple IV antibiotic, chemotherapy drug, or even saline solution-and the hospital runs out. No backup. No substitute. Just silence. This isn’t science fiction. In 2025, 270 generic drugs were in short supply across the U.S., according to the American Society of Health-System Pharmacists. Many of these aren’t fancy new treatments. They’re cheap, old, life-saving medications that hospitals rely on every day. And the reason they keep disappearing isn’t because of a pandemic or bad luck. It’s because the system that makes them is broken.

The Hidden Cost of Cheap Medicine

Generic drugs make up 90% of all prescriptions filled in the U.S. But they only cost 13% of the total drug spending. That’s not a win for patients-it’s a trap. Manufacturers barely make any profit on these drugs. Some sterile injectables sell for under $5 a unit. When your profit margin is thinner than a sheet of paper, there’s no money left for quality control, backup equipment, or extra inventory. So when a machine breaks, a factory gets shut down by the FDA, or a tornado hits a plant in Iowa, there’s no safety net. The drug just vanishes.

Take cisplatin, a chemotherapy drug used for ovarian, lung, and testicular cancers. In 2023, a quality failure at a manufacturing plant in India caused a nationwide shortage. Patients had to delay treatment. Some switched to more expensive, less effective alternatives. The FDA didn’t shut down the plant because of negligence-it shut it down because the facility couldn’t meet basic cleanliness standards. But here’s the catch: that plant was one of only three in the world making enough cisplatin to meet U.S. demand. One failure. Millions of patients affected.

Where Your Medicine Really Comes From

Chances are, the active ingredient in your generic pill or injection was made in China or India. Less than 30% of the active pharmaceutical ingredients (APIs) used in U.S. drugs are made here. China alone supplies about 40% of the world’s APIs. That’s not just a supply chain-it’s a single point of failure on a global scale.

Why? Because it’s cheaper. Labor is cheaper. Regulations are looser. And for generic manufacturers, price is everything. But that convenience comes with hidden risks. The FDA has repeatedly flagged Chinese and Indian factories for poor record-keeping, falsified data, and unsanitary conditions. Yet, because these companies are the only ones offering the lowest bids, hospitals and pharmacies keep buying from them. It’s a vicious cycle: low prices attract more buyers, which pushes competitors out of the market, leaving fewer manufacturers-and more risk.

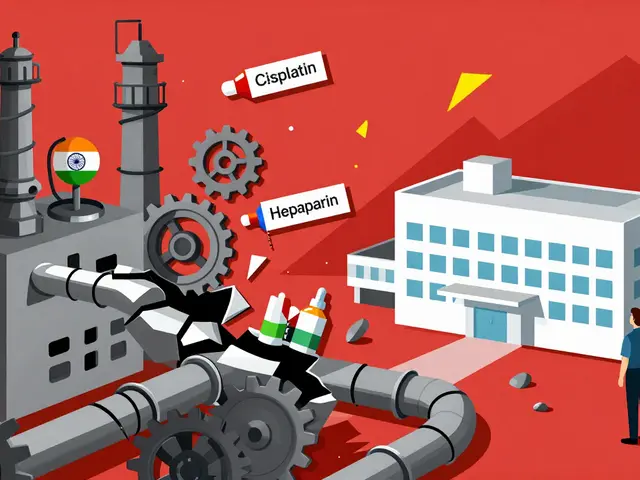

Sterile Injectables: The Most Fragile Link

Not all generic drugs are created equal. Oral pills are relatively simple to make. But sterile injectables-like IV fluids, epinephrine, heparin, and chemotherapy drugs-are a different story. They require clean rooms, specialized equipment, and months of testing. One tiny contamination can ruin an entire batch. And if that batch was the only one being made by a single factory? That’s when the shortage hits.

In 2023, a tornado damaged a Pfizer plant in Iowa. That plant made 15 different generic injectables. Overnight, those drugs disappeared from shelves. Hospitals scrambled. Nurses had to ration doses. Some patients got delayed surgeries. The FDA later confirmed that 20 essential drugs were at risk of shortage during the pandemic-not because of lockdowns, but because the supply chain was already too thin to handle any disruption.

Why Brand-Name Drugs Don’t Have This Problem

Brand-name drug companies don’t face the same shortages. Why? They have money. Lots of it. They invest in multiple manufacturing sites across the globe. They keep extra stock on hand. They can afford to pay more for quality control. They don’t compete on price-they compete on patents and innovation.

Generic manufacturers? They’re stuck in a race to the bottom. The lowest bidder wins the contract. So when one company shuts down production because it’s no longer profitable, there’s no one else ready to step in. For many older generics, manufacturing has shrunk to just one or two companies. That’s not competition. That’s a monopoly by default. And when one fails, the whole system stumbles.

What Happens When the Medicine Disappears

It’s not just about inconvenience. It’s about lives. Pharmacists report spending 20 to 30% of their workweek just trying to find alternatives. One hospital pharmacist told a survey: “I’ve spent entire weekends calling pharmacies across three states just to find a single vial of epinephrine.”

Doctors are forced to substitute drugs that aren’t as effective. Cancer patients get delayed treatments. Diabetics get insulin alternatives that cause unpredictable blood sugar swings. Emergency rooms run out of antibiotics, leading to longer hospital stays. In 2024, drug shortages hit a record 323 products-higher than the previous peak in 2014.

And it’s not just hospitals. Nursing homes, clinics, and even home care providers are affected. Patients who rely on daily injections for chronic conditions are left without their medication. Some skip doses. Others pay out-of-pocket for expensive alternatives. The burden falls hardest on low-income patients and those with complex medical needs.

Why Tariffs Won’t Fix This

Some politicians say the answer is to bring drug manufacturing back to the U.S. by slapping tariffs on imported APIs. But experts warn that’s like putting a bandage on a broken leg. Tariffs would raise the cost of raw ingredients. That would make generic drugs even more expensive to produce. Manufacturers would either raise prices (which defeats the purpose of generics) or quit making them altogether.

The Center for Strategic and International Studies (CSIS) found that tariffs could actually worsen shortages. Higher costs mean fewer companies can afford to make low-margin drugs. Fewer companies means fewer backups. And that means more risk, not less.

Plus, rebuilding domestic manufacturing isn’t simple. It takes 5 to 7 years and $20 to $30 billion to build new sterile injectable facilities. There’s a shortage of trained workers. Regulatory approvals take years. And even if we built all the plants tomorrow, we’d still need foreign suppliers for APIs. The system is too interconnected to just “onshore” it overnight.

What’s Being Done-and Why It’s Not Enough

There are proposals. The American Hospital Association wants mandatory six-month stockpiles of critical generics. Congress has introduced bills to require transparency on where APIs come from. Some lawmakers are pushing public-private partnerships to fund domestic production.

But progress is slow. Federal agencies like the FDA and HHS have seen staff cuts and budget reductions. Inspections of foreign facilities have increased, but domestic oversight has weakened. There’s no unified plan. No funding. No urgency.

Meanwhile, the Association of Accessible Medicines keeps warning: “Without changes to the pricing model, shortages will only get worse.”

The Real Solution: Pay More for the Essentials

There’s no magic fix. But there is one clear path forward: pay more for the drugs that save lives.

Instead of letting the lowest bidder win, pay a fair price for critical generics. Let manufacturers make enough profit to invest in quality, backup production lines, and inventory. Reward companies that diversify their supply chains. Fund domestic manufacturing for the 20 to 30 drugs that are most essential-antibiotics, IV fluids, chemotherapy agents, and emergency medications.

It’s not about making generics expensive. It’s about making sure the ones we can’t live without are always available. We don’t need to make all drugs in America. We just need to make sure the ones that keep people alive aren’t held hostage by a broken pricing system.

Patients shouldn’t have to pray their hospital has enough heparin. Nurses shouldn’t have to become drug detectives. And doctors shouldn’t have to choose between two equally risky treatments because the cheapest option ran out.

This isn’t just a supply chain problem. It’s a moral one.

Why are generic drug shortages getting worse?

Generic drug shortages are worsening because manufacturers operate on razor-thin profit margins, making it unprofitable to invest in quality control, backup production, or inventory. With manufacturing concentrated in just a few countries and only one or two companies making most drugs, any disruption-whether a factory shutdown, quality failure, or natural disaster-causes nationwide shortages. The system was designed for low cost, not resilience.

Which generic drugs are most at risk of shortage?

Sterile injectables are the most vulnerable-especially IV fluids, antibiotics like vancomycin, chemotherapy drugs like cisplatin, and emergency medications like epinephrine and heparin. These require complex, sterile manufacturing processes and are often made by just one or two companies. Oral generics are less risky because they’re easier and cheaper to produce.

Does the U.S. make its own generic drug ingredients?

No. Less than 30% of active pharmaceutical ingredients (APIs) used in U.S. generic drugs are made domestically. About 40% come from China, and a large portion comes from India. The U.S. relies on foreign suppliers because they offer the lowest prices, even though many have a history of regulatory violations.

Can tariffs on imported drugs solve the shortage problem?

No. Tariffs would raise the cost of raw ingredients, making it even harder for manufacturers to profit on low-cost generics. This could push more companies out of the market, reducing competition and increasing shortages. Experts warn tariffs could make the problem worse by destabilizing an already fragile supply chain.

What can hospitals and pharmacies do right now?

Hospitals are using workarounds: stockpiling when possible, switching to alternatives, compounding drugs in-house, or rationing doses. But these are temporary fixes. Pharmacists spend 20-30% of their time managing shortages. Without systemic change-like fair pricing and diversified manufacturing-these efforts won’t stop future crises.

Are there any long-term solutions being proposed?

Yes. Proposals include creating a strategic stockpile of critical generics, requiring transparency on API sourcing, offering subsidies to manufacturers of high-risk drugs, and funding domestic production for essential medications. But progress is slow due to funding cuts, regulatory delays, and lack of political will. Real change requires paying more for the drugs we can’t afford to lose.

Rachel Liew February 2, 2026

I work in a nursing home. We ran out of saline bags last month. Had to call 12 pharmacies just to get 5. Nurses cried. Patients suffered. This isn't politics. It's people dying because we care more about saving a few cents than saving lives.

vivian papadatu February 2, 2026

The systemic failure here is staggering. We outsource the most critical components of healthcare to nations with weaker regulatory oversight because we prioritize cost over consequence. This isn't globalization-it's gambling with human lives. And the worst part? We all know it, yet we keep buying the cheapest option at the pharmacy counter.

Naresh L February 4, 2026

I come from India. Many of these factories are my neighbors. We are not villains. We are workers trying to feed families. But the pressure to cut corners? It comes from the other side of the world-from hospitals that demand $3 vials of epinephrine. The real blame lies in the pricing model, not the people making the drugs.

Sami Sahil February 6, 2026

bro this is wild. my aunt got chemo last year and they gave her a substitute that made her throw up for 3 days straight. they said it was "the only one available". how is this even legal? we pay for healthcare but get treated like we're lucky to get anything at all

Aditya Gupta February 6, 2026

We need to pay more for the essentials. Not all drugs. Just the ones that keep people alive. IV fluids. Antibiotics. Chemo. If we can afford $800 for a new phone, we can afford $15 for a vial that saves a kid’s life.

June Richards February 7, 2026

OMG I knew this was happening but I didn’t realize it was THIS bad. Like, how are we still letting this happen? 🤦♀️

Jaden Green February 9, 2026

The irony is thick enough to spread on toast. We celebrate free markets, yet we’ve created a market where the only viable business model is to produce life-saving drugs at a loss-and then wonder why they disappear. This isn’t capitalism. It’s capitalism with a death wish. The solution isn’t tariffs. It’s abandoning the delusion that everything must be cheap.

Lu Gao February 9, 2026

Actually, I think the real problem is that we don’t have enough people willing to work in sterile manufacturing. It’s gross, dangerous, and pays peanuts. Maybe instead of blaming China, we should ask why no American wants this job. 🤷♀️

Nidhi Rajpara February 10, 2026

Dear all, I must respectfully point out that the root cause lies in the absence of a national pharmaceutical sovereignty policy. Without a legally binding framework mandating domestic production of critical APIs, the current system remains structurally unsound. This is not merely an economic issue-it is a matter of national security.

Donna Macaranas February 11, 2026

I just read this and sat quietly for 10 minutes. I don’t know what to say. I just hope someone’s listening.

Melissa Melville February 13, 2026

So let me get this straight. We outsource the medicine that keeps people alive to countries with sketchy factories… so we can save $2 on a vial of saline? Bro. We’re not saving money. We’re just making the bill come due in a hospital bed.

Bryan Coleman February 14, 2026

I worked at a compounding pharmacy for 8 years. We made IV meds when the big guys couldn’t. We had 3 people doing 20-hour shifts. No one got paid well. No one got thanks. But we kept the lights on. This system is held together by exhausted, underpaid workers. That’s not resilience. That’s a miracle.

Chris & Kara Cutler February 16, 2026

This needs to be a national emergency. 🚨 We can’t keep pretending this is normal. My sister’s on chemo. We lost her meds for 3 weeks. She cried. We all cried. Pay more. Just pay more.

Ed Di Cristofaro February 18, 2026

You wanna fix this? Ban all imports. Make every damn pill in America. If you can’t afford it, don’t get it. People die every day because they’re too lazy to pay for quality. Wake up.

Deep Rank February 18, 2026

Honestly, this whole situation is a perfect storm of greed, ignorance, and misplaced patriotism. We blame China for everything, but we’re the ones demanding $1 antibiotics. We’re the ones who closed our own plants because we didn’t want to pay workers $15/hour. We’re the ones who voted for politicians who promised cheap drugs but never funded the infrastructure to make them. We’re not victims here-we’re the architects of this disaster. And now we’re surprised when the house burns down? 🤦♂️