Insurance Tips for Medications and Healthcare Costs

Dealing with insurance can feel confusing, especially when it comes to paying for medications or treatments. If you're trying to understand how insurance affects your healthcare costs or medication options, you’re in the right spot. This guide explains insurance basics and how it ties into your medical needs without getting too technical.

How Insurance Can Impact Your Medication Choices

Insurance plans often decide which medications they cover, how much you pay for them, and even where you can get them. Sometimes, your preferred drug might not be fully covered, meaning you have to pay more out of pocket. Knowing if your insurance covers generics or brand-name drugs can save you money. Check your plan’s formulary—that’s the list of covered medications—to see what’s included and if there are cheaper alternatives.

Not all treatments are straightforward when it comes to insurance. For example, specialty drugs or newer meds often have stricter rules or require prior approval. This extra step can delay your treatment if you’re not prepared. Talking to your doctor and pharmacist about insurance hurdles can help you get coverage faster or find similar medications that your plan prefers.

Practical Tips to Manage Insurance Costs

One easy way to reduce your expenses is by using online pharmacies or discount programs that insurance partners with. Some websites and resources might offer coupons or price comparisons to help you find the best deals. But be cautious—always verify that the pharmacy is legitimate and your insurance benefits will apply.

If you face a denial or high cost, don’t hesitate to ask for an appeal or financial help. Many pharmaceutical companies and patient assistance programs offer support for those who qualify. You can also explore government or nonprofit programs aimed at specific diseases or conditions that help cover medications or treatments.

Remember, insurance is just part of the puzzle. Staying informed about your options and communicating openly with healthcare providers gives you a better shot at affordable and effective care. Your health matters, and understanding insurance challenges helps you take charge of your treatment journey.

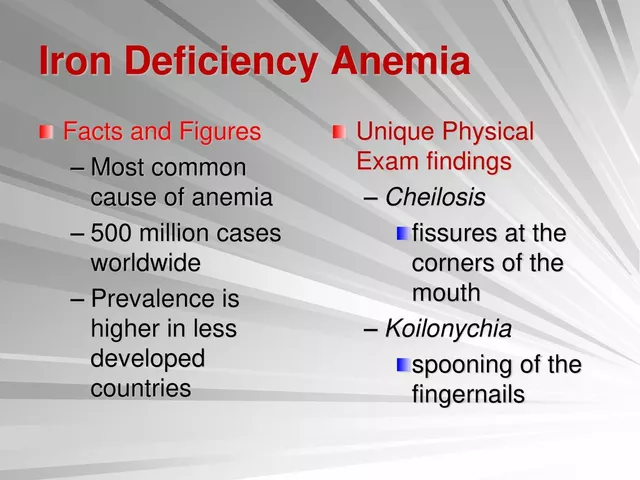

The Financial Impact of a Neuroblastoma Diagnosis: Navigating Costs and Insurance

As a parent, receiving a neuroblastoma diagnosis for your child can be overwhelming, and the financial impact adds to that stress. Navigating the costs associated with treatment and insurance can be challenging. In my blog post, we'll discuss various aspects of this financial burden, including the cost of treatments, insurance coverage, and resources available to help families manage these expenses. We'll also explore ways to advocate for your child's care and work with healthcare providers to minimize out-of-pocket costs. Stay tuned for this essential guide to understanding and managing the financial impact of a neuroblastoma diagnosis.